A look into capital inflows from startups and their distribution reveals interesting trends. First, a huge chunk of investments is going into products that have yet to reach full development. For instance, investment in technology companies increased from US$25.97 million in 2015 to US$88.32 million by 2015.

2019 was a record year for investments, with a lot of activity happening in the last two Quarters where total funding closed at $1.93 billion. The logistics, energy, AgTech, and finTech industries have contributed greatly to the rise. The Q1 of 2020 registered a higher investment number at $283 million, exceeding the figure in Q1 of 2019 by US$26 million due to an over-performance by the Fintech and Transportation sectors. Despite these positive numbers, funding directed to seed and pre-seed investments decreased in that quarter.

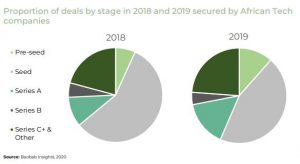

Pre-seed investments grew by 5.73% in 2018 to 9.49% in 2019. It remains to be seen whether this investment will remain a long-term trend as we are seeing investors go for ventures that are yet to develop a fully nurtured product. The report also examines the market drivers behind some of the figures arrived at.

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?