The Nigerian tech world had mix fortunes in the year 2017. Negative and positive sides were witnessed in the tech field, but the most encouraging part is that the positivity outplayed the negativity in the year 2017 hence making the year 2018 a promising one on the Nigerian tech sector. A good number of local startups attracted foreign investors making the tech world to spread to a number of cities apart from Lagos. Here are five startups in Nigeria that call for keen monitoring in 2018. The choice of selection was based on economic empowerment of the startup selected.

The startup which was founded in 2017 is hoping to give an online payment a different look. The company was founded by Hugo Obi a Nigerian local. Obi sees that is relatively easier to make payments of digital products using airtime rather than using debit or credit cards. The stressful nature of using the debit or credit cards makes people agree with the founder.

Every one like an easy life and Monapay’s main aim is to make payments easier. The replica of Monapay is the CodaPay which has been operational in Malaysia and Indonesia markets since 2013 and is offering services to people without payment cards. Before the launch, the founder had already demonstrated how the platform works to the Techpoint team via another platform that is in his possession Maliyo. On 30th December 2017, the startup won N2 million from a fintech event organized by Access Bank. That shows that the company has much potential of reaching to greater heights.

Thrive Agric gives one an opportunity to empower farmers, fund a farm, learn practical agricultural tips and later on share harvest. The startup has helped farmers within its operational area. Thrive Agric acts as a link between farmers and individuals who have interest in farm investment. It allows insured and easy investment to the individuals with a promise of 23% ROI in less than one year and farmers access the required funding to concentrate on their farming activities.

The startup has been in a position to sell 200 hectares of farmlands since its launch in 2017. The figure is still less than a fraction of 80 million hectares of the Nigerian land. Thrive Agric also was listed as part of Ventures Platform’s second cohort that gave it $20,000 in funding.

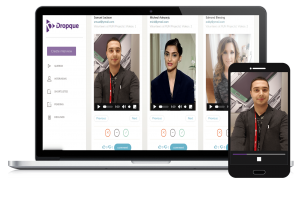

Africa has come out as one of the continents in the world where getting a job is a hard task. Given the long duration, it takes before one gets feedback after application, it kills the job seekers morale of persistent application. A good example is the Nigerian Immigration Stampede of 2014 which led to the loss of lives due to job hunting process. The situation could have been avoided in case there was a way of applying for the job without necessarily involving the applicants physically. Droque came in to do away with physical appearance.

The startup helps in saving 50% of the time used for recruitment both for the employee and the candidate according to Opeyemi Akinwoleola who is the founder of the startup. Dropque’s interface allows recruiters to send video, file or text-based interviews to prospective candidates, whose responses are sent to recruiter’s dashboard for easy shortlisting and collaborative assessments with other members of the recruitment team. The startup has already acquired 3,100 candidates who have taken interview using the software.

FarmCrowdy was founded in 2017 as a digital and crowd-funded agricultural platform which empowers farmers in Nigeria. The platform gives individuals a chance to sponsor agricultural produce of their choice and stand a chance of getting returns within a year. The platform which was founded by Onyeka Akumah received an overwhelming reception. It has been so important to the farmers in the rural areas than compared to urban areas. The startup became the first and the only African startup to be selected by Techstars Atlanta to undergo its accelerators program with $120,000 in funding in August 2017. The funding was followed by another funding from Techstars Atlanta and other international investors worth around $1 million.

QuickCheck aims at providing banking services to the unbanked population. Despite the fact that 20 million people are using a smartphone or mobile app in Nigeria still a good number of them are not happy with the banking services offered by direct Nigerian banks app. Unlike Paylater and Zoto, QuickCheck is working on other products, which are currently in the pipeline. Apart from the airtime recharge services and loans, the startup makes available debit cards and allows users access unlimited bank accounts using a single mobile app. Statistics show that averagely a Nigerian possess two bank accounts which means the person has at least two mobile apps on a single mobile phone. QuickCheck’s intended solution might take away the stress of having to open some banking apps to access one’s multiple accounts.