There is a rapid change in the remittance market that has been witnessed in the recent past. Thanks to the huge role played by technology and innovation. The two are transforming the payment system as digitized financial services create new job opportunities daily. Mama Money, a cross-border money transfer service allows migrants to send money to their home country from South Africa. It does that faster and at an affordable rate. This is an ideal example of the innovation found in the region.

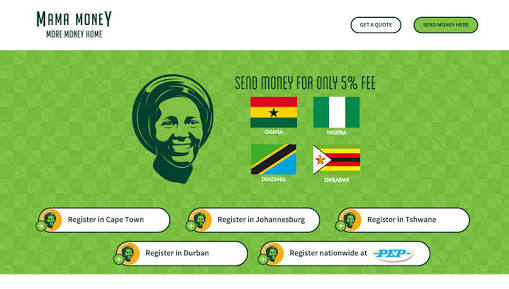

Based in South Africa, the mobile platform offers remittance services at lower cost and more convenient. Mama Money co-founder and director Mathieu Coquillon said that the platform makes payments through mobile money networks within Africa. This helps in solving the challenges of the last mile of channeling money to rural communities. African migrants managed to send home more than $70 billion in remittance in 2017. The value was an increase of more than 10% compared to 2016 and over 36% compared to the last decade. Sub-Saharan Africa is still the most expensive region globally to remit money back home with an average cost of 9.3% sent in 2017. Therefore it called for fintech remittance solutions such as Mama Money.

Mama Money has been operational for about four years. It used its first two years to apply for a license from the South African Reserve Bank and developing its technology. The co-founders Raphael Grojnowski and Coquillon have strived to make each coin count. Mama money has been operating on a small budget. But it gained from an investment it raised at the end of 2017 at the period of its hyper-growth. According to Coquillon, they got it wrong when they decided to reinvent the project prematurely by disabling remittance cash payments. He said that they realized quickly enough that many of their clients lacked bank accounts. Therefore, they had to get ways of accepting cash at retail stores.

By now the main challenge that the two faces are locating their next project given that there are numerous opportunities in the financial solution scene. However, the critical factor to them has been focusing on the need of their customers. Furthermore, they are facing the challenge of getting talent for product development and marketing. This one will be at the top of their list in case they land an investment worth a million dollar. Even though mama Money still has a long way to go regarding marketing, the platform already runs an active mode of marketing by getting to their clients using their network of more than 700 entrepreneurs across SA. Coquillon added that getting to their clients instead of the clients going to them has been a success. That led to the doubling of the business within one month. This reflected the hard work that has been put in place by the founders in four years.

Apart from playing their core role, startups such as Mama Money contributes to economic growth, financial inclusion, and creation of fintech innovation all over Africa. The startups help to offer solutions to the daily challenges faced by Africans living in the diaspora.