TechInAfrica – Technology has slowly crept up into embedding itself towards various aspects in our everyday life. One of the most notable embodiments is the continuous advancement of insurtech—short for insurance tech—which refers to the use of technology innovations designed to squeeze out savings and efficiency from the current insurance industry model. Being an old business in the financial world, insurance tends to favor those with deep pockets and long experience in the market. Insurtech poses a potential solution to address these staggering states.

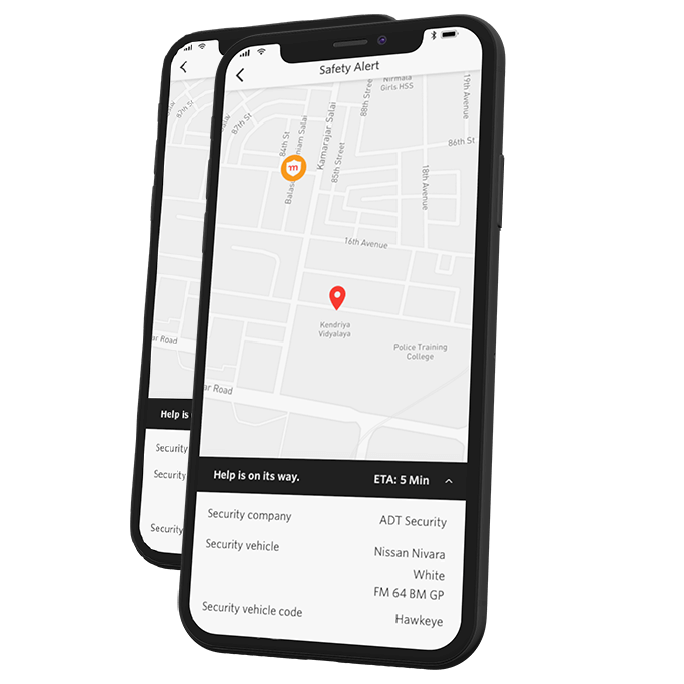

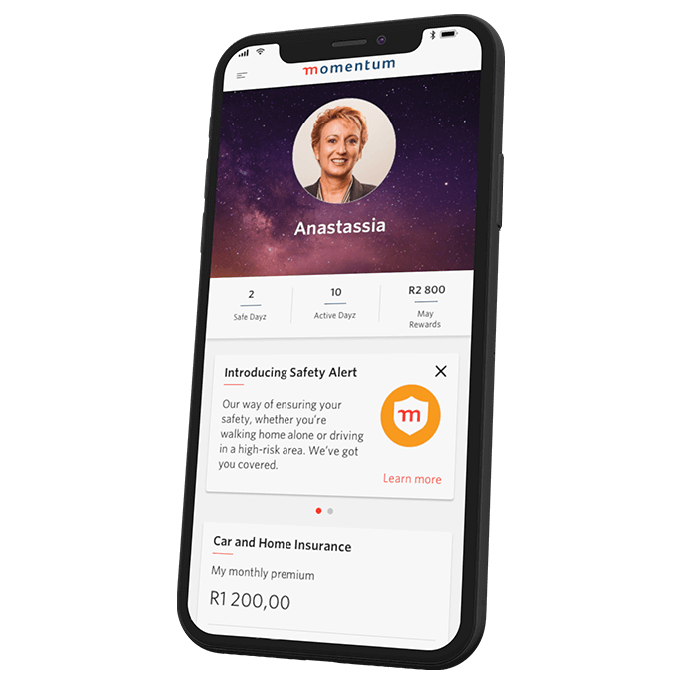

Momentum, an insurance company based in South Africa, launches its newly-embedded Safety Alert App. The app offers a panic button to be linked towards armed response—whenever the users’ feel like their lives are being threatened by their surroundings. Via Momentum’s official site, the company claimed, “Momentum Car and Home Insurance cares about your personal safety; that’s why we’ve introduced Safety Alert. A panic feature that allows you to call for help when your own personal safety, or someone else’s safety is threatened.”

With a network of 1,500 armed responders in South Africa, users can now call for dire assistance with a push of a button. Additionally, the Safety Alert feature is available to all existing Momentum Car and Home Insurance policyholders, as well as any new clients who take cover with us, at no additional cost, until 31 August 2020.

Etienne du Toit, Chief Commercial Officer of Momentum, asserted that this notion is based to provide a safer state of mind for all new and existing customers. To help their clients minimize and mitigate the risks of each and every aspect of their daily lives—be it on the road or in their homes on a personal scale. The Safety Alert App promotes much shorter delay times compared to conventional dialing of emergency numbers; dispatches of armed responders would immediately know the details and the exact location pinpointed on the victims’ GPS.

Furthermore, du Toit also expressed, “Monthly security fees can be prohibitive for many South Africans, who are trying to stay financially afloat in particularly trying economic times,” claiming that Safety Alert appears as a game-changer in the insurtech scene.

Source: itnewsafrica.com