TechInAfrica – Meet Seun Ayegbuzi , the Coverdor founder – Coverdor is Nigeria’s first fully digital insurance platform that enables Nigerian millennials access simplified insurance anywhere, anytime, directly from there mobile device and also manage all aspects of insurance transactions in realtime, completely online.

First of all, can you pitch us your company in just a few sentences?

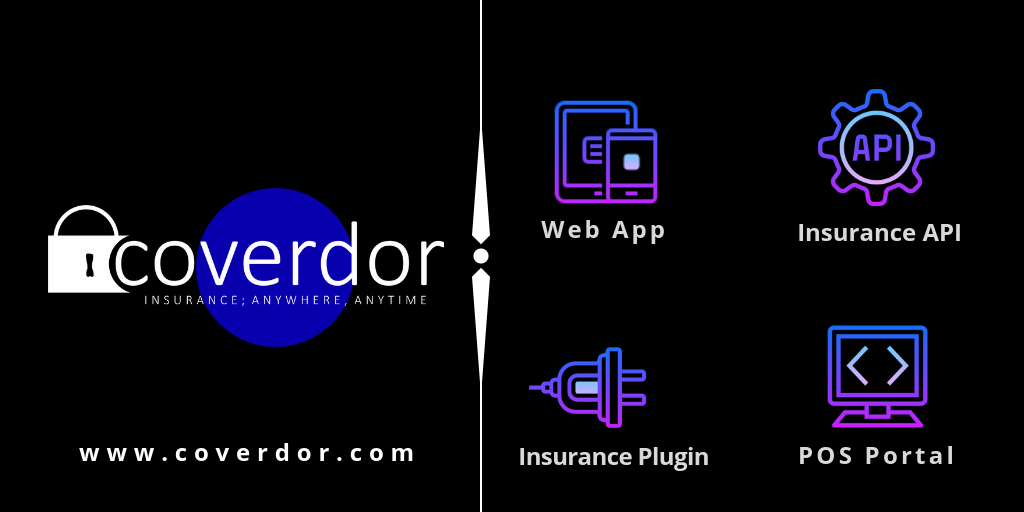

Coverdor is an AI-driven insurance technology (Insurtech) startup that provides customers with a complete digital insurance experience and easy access to simplified insurance products and services; entirely online. We also enable service providers, retailers and ecommerce to cross-sell insurance-as-a-service at their point-of-sale.

Our web app is Nigeria’s 1st fully digital insurance platform, where users can easily insure their everyday items (gadgets: smartphone, tablets, laptops etc) against liquid, mechanical, accidental (screen crack) damages and theft directly from our platform or at the point-of-sale of a partner ecommerce web or retail outlet.

Can you tell us more about yourself, your personal background, your experience and how you went to this journey ?

My name is Seun Ayegbusi, I am a tech entrepreneur, business and digital product development expert, a serial innovator with extensive knowledge of the Afican emerging markets. A graduate of Olabisi Onabanjo University, and an alumnus of London Academy Business School. My compelling range of experience in the startup scene, where I last worked as the Team lead, business development of a Lagos based tech startup (a portfolio company of Cchub) and my passion to tackle one of Africa’s most stubborn social development issues birthed the startup – Coverdor .

Insurance is created for the fundamental good of everyone, especially in a clan like Nigeria with a high level of uncertainties and emerging risks, however, I discovered that our insurance system lacks the enablement to bring the “fundamental good in insurance” to the very people that needs it the most, low income earners and a population segment of millenials under 35, who are lost in the disconnect. This is the reason I founded Coverdor to bridge the insurance distribution gap to the very people that are excluded from coverage.

Can you tell us more about Nigeria ? Why this market?

Nigeria is a blessed nation especially with the huge population which presents a diversed market any business would thrive on. However, with such huge population comes a large un(der)banked market segment, with a wide financial exclusion gap and low insurance penetration rate, which minimizes the economic capacity and prosperity of the people; even though insurance is key for wealth creation and sustenance. This is the reason we built Coverdor, to help increase financial inclusion and deepen insurance penetration through easy and smart access to digital insurance products and services for the most underserved demography in Nigeria.

What are the main issues you have been facing Nigeria ?

There is the issue of lack of trust and process complexity in the Insurance system in Nigeria, which underlines the apathy displayed by most people against insurance, however, with our digital transformation approach to traditional insurance we sure will be able to scale through these issues. The introduction of our fully digital insurance platform and self serviced policy management system, coupled with our automated Artificial Intelligent -AI powered claims processing will bring about transparency, ease of use and simplicity to our insurance process. Especially with our proposed underwriting partnership with a leading insurance carrier in Nigeria with a proven track record of early claims settlement will help reduce the issue of trust with our process.

Who are your main competitors around? And outside of the country, who are your inspiration?

We consider our main competitors to be other digital insurance platforms performing insurance distribution role within the ecosystem (although they are insurance price comparison platforms).

Aside these, our indirect competitors are insurance brokers in Nigeria.

Our inspiration outside the country are Zhong An Insurance, Simplesurance, and Lemonade.

What is your point of view, as a startup founder, about Nigeria ?

Nigeria is a dynamic economic ecosystem and perhaps the best market to startup a business in Africa, has it offers enough opportunities and challenges to strengthen a founder’s capacity at operating his/her business. Nigeria is a market that will teach you patience, persistence, and build tenacity in any founder, because no entrepreneur makes it without these qualities and Nigeria is such a place that you will learn those fast. If you make it as a startup founder in Nigeria, then you can make it anywhere else.

Is it hard to find investors there ?

It is still challenging to find the right investor for your type of business in Nigeria, although the recent influx of startup incubation/acceleration programs and local VC has made finding investors a bit better, however, getting the right investor – Angel or VC who will not only bring on cash to your business but add vualable experience and expertise also is the challenging part. An investor who is patient enough with geniune interest in your industry or your innovation and business model is still such the big deal here.

What do you think is lacking to Nigeria to develop it more? What are the main barriers to develop a startup there?

I think what is lacking in Nigeria is the full cooperation of the government to get fully committed to the startup scene with the implementation of enabling policies that will ease starting, operating, and succeeding as a business in the country. Policies like, tax exemption benefits for up to 4years will allow startups thrive well through infancy. Aside these, we also need to close the infrastructural gap in the country which is daily increasing the cost of doing business in the country.

What is your perspective for the next years on Nigeria and more regionally on Africa?

I believe Nigeria will witness more successful startup businesses that will expand their operations to other continents of the world within the coming years, and we will see the emergence of startup unicorns in Africa. Also I see the future coming upon us in Africa; and its a future that beacons hope, however, African elites must learn to inject more capital into African businesses, and make the concept of Africapitalism a reality.

As you know, we are always on the look of great startups, new products and amazing entrepreneurs, could you name a few locally or regionally in Nigeria ?

Placements.ng; a recruitment tech startup

Doctoora; an health tech startup

For the further information go visit http://coverdor.com/; and send an email to [email protected]