TechInAfrica – Africa-focused private equity firm Adenia Partners has taken part of share in Herholdt’s, an SA-based distributor of low-voltage electrical and solar equipment.

Andrew Bahlmann and Nicolas Souvaris from Deal Leaders International were involved as the main advisors of the deal.

“The chemistry and synergy between the Adenia and Herholdt’s teams were there from day one and I have no doubt that their combined efforts will be formidable. It is exciting for us to see another great South African company attract an international partner for its next phase,” said Bahlmann, Chief Executive of Deal Leaders International.

The stake acquisition will lead Adenia’s investment in the group on new store openings, partnership with key promoters, digitizing the services, and looking out for future acquisitions.

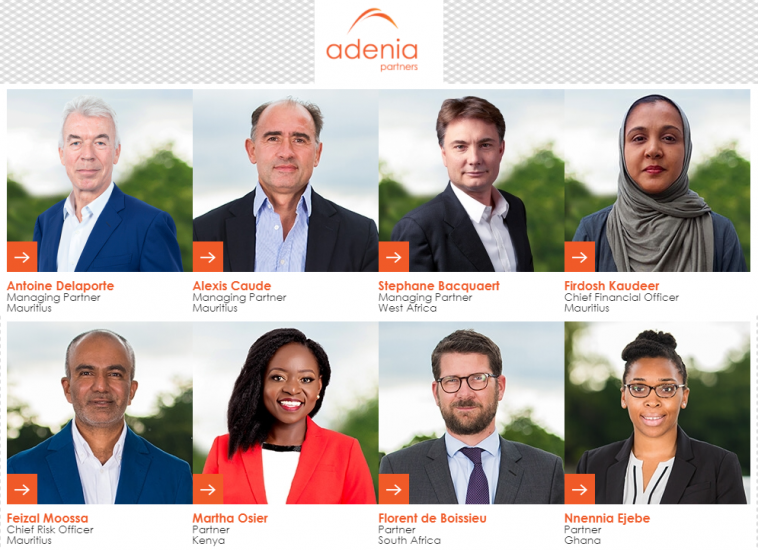

“We are delighted to begin our South African journey by investing in Herholdt’s, a fast-growing business with an impressive corporate culture. As a responsible investor, we were particularly attracted by the potential for high contribution to the SDGs, and specifically to improve access to reliable and affordable energy,” said Florent de Boissieu, Partner at Adenia.

“We are pleased to continue our pan-African expansion with our newest office in Johannesburg, as we believe the on-the-ground presence of our team is instrumental in actively supporting our investees.”

Heine Herholdt, CEO of the company, commented on the stake control, “We are thrilled to welcome Adenia as an investor and look forward to continuing our growth with their strategic guidance and steadfast approach to improving governance.

“The partnership is in perfect alignment with Herholdt’s ambitions to become a national market leader, while meeting the highest industry and environmental standards.”