TechInAfrica — Over the course of 2019, African tech companies successfully secured $1.27-billion in funding across 167 disclosed deals. This investment report had been conducted by a London-based research firm, Briter Bridges.

The summary is based on research and data collected by GreenTec Capital Partners senior company builder Maxime Bayen and includes deals that were disclosed in 2019, up to 30 December.

It still remains unclear what methodology Bayen used to define African tech startups for the report. It is not clear, for example, whether he opted to include companies of say 10 years old, as well as startups and whether he included companies that while having African founders are not headquartered on the continent.

Briter Bridges founder, Dario Giuliani said in a statement that the report integrates Bayen’s list of companies that secured more than $1-million with the research firm’s own list of deals below $1-million.

He also explained that the report, which also includes two maps on Africa’s investor landscape, refers to disclosed deals and not what startups in Africa raised in 2019.

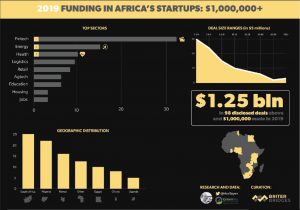

At least 98 of the 167 deals were worth $1-million or more last year, states the investment summary which was published earlier this month.

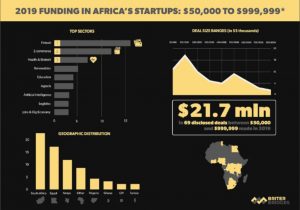

The report also found that African companies closed 69 funding deals worth between $50 000 and $999 999. These transactions total $21.7-million.

It is likely this figure could be higher as some startups have not opted to disclose their deals.

Briter Bridges last Friday (10 January) called on those with information on deals that aren’t part of the summary to add this information to the research firm’s platform.

The summary found that among the big ticket deals — those of at least $1-million and above — the majority of the funding was raised by startups operating in the fintech (over 30 transactions), energy (about 15 deals) and health (10 transactions) verticals.

This is while the top investment destinations were South Africa, Nigeria, and Kenya, respectively.