Early-stage growth equity lender Aruwa Capital Management has announced an undisclosed investment into Pngme, an Africa-focussed fintech company focused on creating financial inclusion.

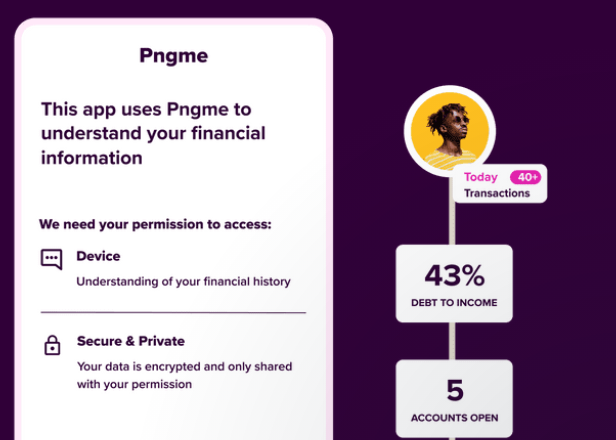

Established in 2018, San Francisco- and Africa-based Pngme is a software application that allows fintechs and other financial players to acquire alternate financing data at scale which in turn unifies it with other data sources and creates a holistic picture of an individual’s financial behavior. The startups’ lending platform creates data processing infrastructure and delivers machine learning-as-a-service for the banking sector, credit bureaus, mobile money operators, and fintech providers. Back in August, Pngme raised a $15 million Serie A round.

Pngme Co-founder and COO Cate Rung described the investment from Aruwa as a step closer to a shared vision of “becoming the highest coverage, financial data platform across Africa.” Adesuwa Okunbo Rhodes from Aruwa Capital expressed excitement in the new partnership with Aruwa, even going further describing it as in-line with “Aruwa’s gender lens investing strategy.” in addition to being female co-founded.

Aruwa Capital’s fund is mainly fixated on the Nigeria and Ghana markets. Stats from Nigeria’s central bank show that the adoption of credit cards in the overall population is less than 5.3 percent. This means a significant chunk of the adult population has no access to credit due to the lack of access to structured financial history and population records.