Uganda is one of the countries with the high level of poverty in Africa. However, the partnership between Binance and Crypto Savannah will work on bridging the wide poverty gap. The partnership will work on improving the country’s economy that will then increase job creation in Uganda. This came out after a meeting between the Blockchain Association of Uganda and Binance CEO Zhao Changpeng. The news was released to the public through a tweet made by Mr. Zhao.

According to Mr. Zhao, the partnership will help Uganda in its economic transformation quest and employment of youth by the use of blockchain. This will be in accordance with the 4th Industrial revolution. He also said that the move will be achieved by bringing more investment in the country and creating more jobs. According to coinmarketcap, Binance is the biggest cryptocurrency exchange globally. The startup records a 2 billion volume of trading in every day. African countries like Kenya, Zimbabwe and South Africa are already enjoying the use of blockchain technology. Ugandan Blockchain Association does not want to lag behind on matters of making transformations by the use of blockchain technology. Furthermore, the association is educating Ugandans about the technology. The education is being carried out by assembling people into blockchain technology-themed events and supporting blockchain projects.

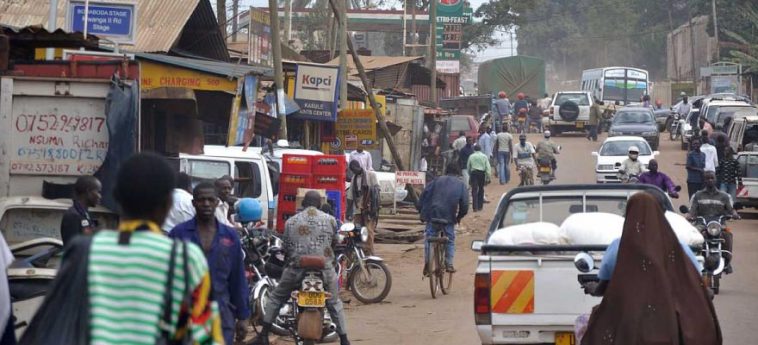

Uganda which is rich in resources has not managed to fully exploit them to the benefit of its 42 million citizens. The blockchain will help the country with money remittance gave that a good number of its citizens are staying overseas. According to the 2016 World Bank data, Ugandans who are staying abroad sent more than $1 billion back to the country.

The partnership also incorporates Msingi East Africa. The organization works on developing a long-term prosperity in EA. This is done via Made in Africa initiative and industrialization. This is an initiative that majors on industrialization across Africa. The blockchain technology is going to help most of Africans more so in the financial sector given that a good number of them are unbanked. Therefore, these calls for a way through which will help them send and receive money.