TechInAfrica – Despite both being decent cryptocurrencies with a lot of background behind them, and despite both being the center of attention when people talk about digital money, Bitcoin and Libra still pose a number of differences from one another. Particularly for Libra who’s been getting a lot of critiques and assessments for the past month or so, this list could provide additional insights and knowledge to those oblivious about the way Libra works—the technology behind it and whatnot. Many still questions whether Libra can even be regarded as a feasible cryptocurrency.

So, what are the differences?

Base Technologies

Like we had stressed in the first paragraph, one of the most notable differences between Bitcoin and Libra is the mechanisms of technology behind it. Let’s take a further look at the exposition below:

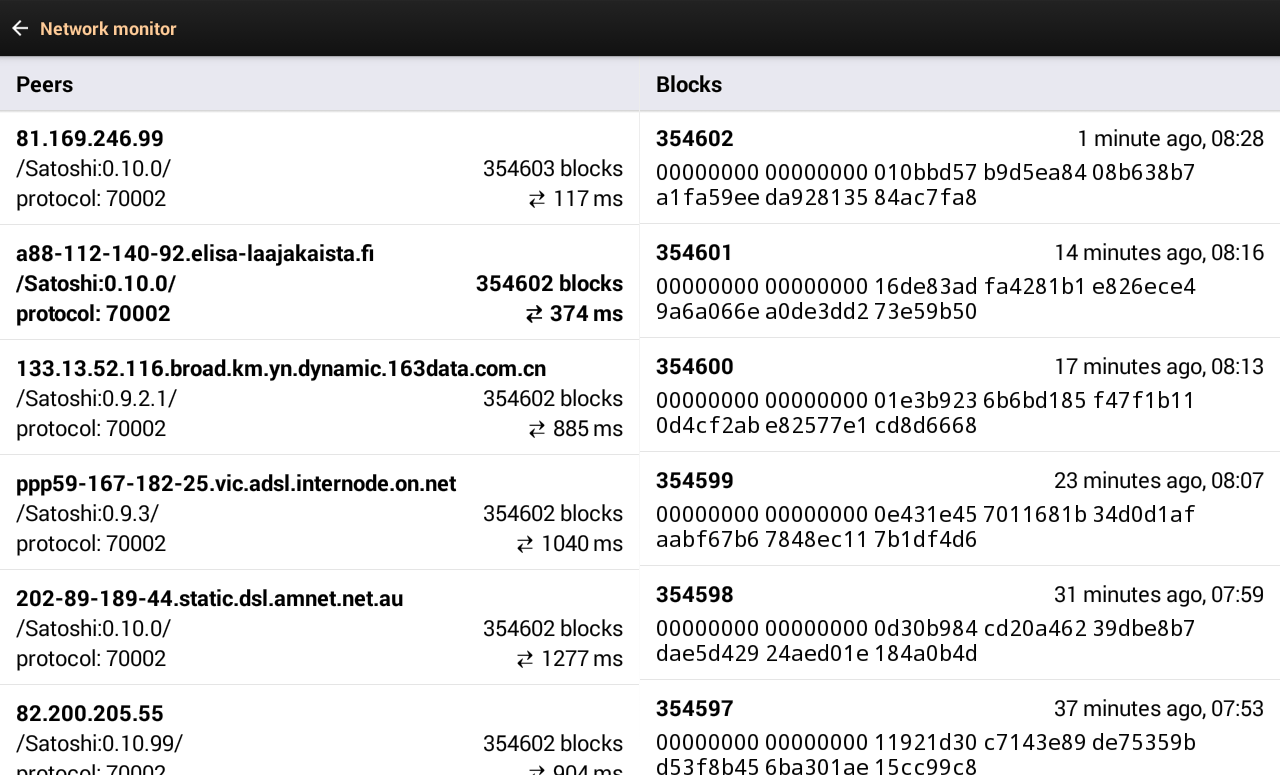

Bitcoin: Transactions are recorded anonymously on a public ledger known as the blockchain. Users are given an address—an identifier of 26-35 alphanumeric characters—in which all their Bitcoins are stored without having to give personal data (not even an email) to the developers. Can I vouch for this? Yes—I’ve started doing mundane surveys for Bitcoin circa 2014 before eventually losing interest.

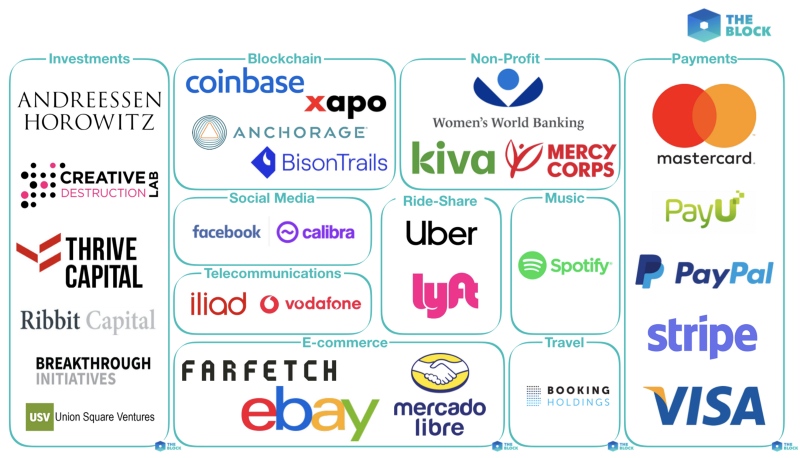

Libra: Transactions are also recorded in a form of blockchain—but it’s not exactly anonymous. Its blockchain is permissioned, which means only trusted parties are able to conduct transactions. This contradicts the general idea of cryptocurrency where the lack of reliance on trusted intermediaries are often emphasized more above any other aspects. For the cherry on top, Libra uses a platform dubbed Calibra for its digital wallet—again, Calibra offers no anonymity as users would (most likely) have to input their personal information in order to manifest such services.

This means you can’t go shopping on Silk Road with Libra, else they’ll catch you with a 9mm Glock under your pillow. Yikes.

Usage Implementations

Bitcoin: Serving as a peer-to-peer payment system, Bitcoin offers users to exchange money, buy things, or make transactions of various kinds without having to go to their nearest branch of their preferred banks. Also, Bitcoin is used as a form of investment—commonly known as HODL—in which people prefer to hold their Bitcoins rather than spending/selling it; hoping for a price surge like it did for the past years. This regards Bitcoin as a rather volatile, unpredictable due to its decentralized nature. Even so, the number of Bitcoin issued will be ‘fixed’ at 21 million, which makes it more feasible to adapt the dynamics of the demand.

Please do not ask us what HODL stands for. Cited from its exclusive page on Wikipedia:

It originated in a December 2013 post on the Bitcoin Forum message board by an apparently inebriated user who posted with a typo in the subject, “I AM HODLING.”

Libra: Serving as a cross-border payment system, Libra aspires to maintain a stable value—sometimes even dubbed as “stablecoin”—which means it also avoids future price surges and drops by tying itself to conventional, government-issued currencies and other assets. So HODLing Libra would be meh decision; why would anyone invest in currencies of fixed value? David Marcus, the Facebook executive leading the blockchain initiative, asserted that Libra will work more like a traditional currency, in comparison to more popular ones like Bitcoin and Ethereum.

Libra’s number, on the other hand, will not be of fixed amount. Developers can issue more and less currencies to keep up with the resources, eventually maintaining the price strength even when demand is high.

Regulatory Questions

Bitcoin: Rules out the need for intermediary regulators, in which users are expected to seamlessly conduct their financial—bitcoinal, should I say?—transactions. In other words, there are none who have their strings attached to intermediary simply because there was no need of it. Despite miners are able to oversee and record transactions, Bitcoins are still free of regulations because there is no reason to trust these miners as regulators.

Libra: Strictly requires intermediaries who compose regulations from time to time. The Libra Association—consisting of 28 founding members and counting—serves as a fervent element of Libra, in which it depends heavily on the organization. Moreover, security measures regarding Libra also raised some public questions, as well as how it would fit into existing, conventional financial regulations.

Libra is also expected to launch in early 2020.

What do you think? Will Libra be able to fit in to our existing economy system? Or will it be regarded as something irrelevant?

Source: cnbc.com