TechInAfrica — Credolab, a Singapore-based fintech company, has officially announced its expansion in Africa, starting in South Africa. The company develops bank-grade digital scorecards for banks, consumer finance companies, auto lenders, online and mobile lenders, insurance companies, and retailers. It targets those people who are new to banking or credit in order to encourage financial inclusion in emerging economies by performing credit scores to more people.

As Michel Massain, Sales Director for Europe and Africa at CredoLab, put it, “South Africa is a country desperately in need of ways to help more people access financial products and participate in the economy. It is estimated that about 76% of the Sub-Saharan African population needs credit but cannot access it, as they are excluded from the traditional banking sector.”

“You need a credit score to participate in the economy, but what about people who are new to credit and new to banking? How do they get a credit score? How can someone with no credit history get a credit score? And how can they start a business if they can’t lend money to do so?”

“Many people in South Africa remain neglected by the mainstream financial sector and are invisible to lenders because of a lack of data for risk assessment. Existing options for the underbanked are limited, traditional credit scoring is inadequate, and as a result, many turns to informal money lending with excessive interest.”

“CredoLab was launched in 2016 in Singapore to solve one problem: the lack of instruments available to assess the creditworthiness of nearly two billion consumers globally.”

“By harnessing the power of Artificial Intelligence applied to smartphone data, we enable financial institutions to grow by reaching new segments that they weren’t able to access through traditional systems, at a lower cost of risk, based on real-time decisions.”

As stated by CredoLab, its AI systems gather over 50,000 data points from a consumer’s smartphone and convert them into more than 500,000 behavioral features. This collection process is under consensus and permission. It is also anonymous and the collected data are stored securely within the country.

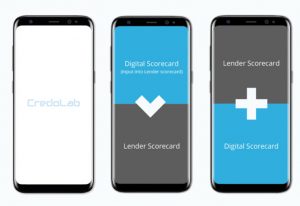

This non-traditional data and predictive analytics for credit scoring enable lenders to expand their group of borrowers while at the same time minimizing risks. “Millennials, new graduates, self-employed and other thin credit history customers increasingly try to access credit, but to no avail. Here, digital scorecards help provide predictive insights into borrower behavior, thereby redefining credit-decisioning,” Massain remarked.

Peter Barcak, CEO and Co-Founder of CredoLab, said, “We are excited about our launch into South Africa, which is our gateway to the African continent, where too many people remain locked outside of the mainstream economy because they do not have the credit history in the traditional sense to participate in it.”

Barcak also added regarding their expansion to Africa,“With plans to expand further into other countries on the continent, we hope that CredoLab will help to remove a key barrier to entry in South Africa and complement traditional credit scoring systems with the power of behavioral data.”

Source: Tech.Africa

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?