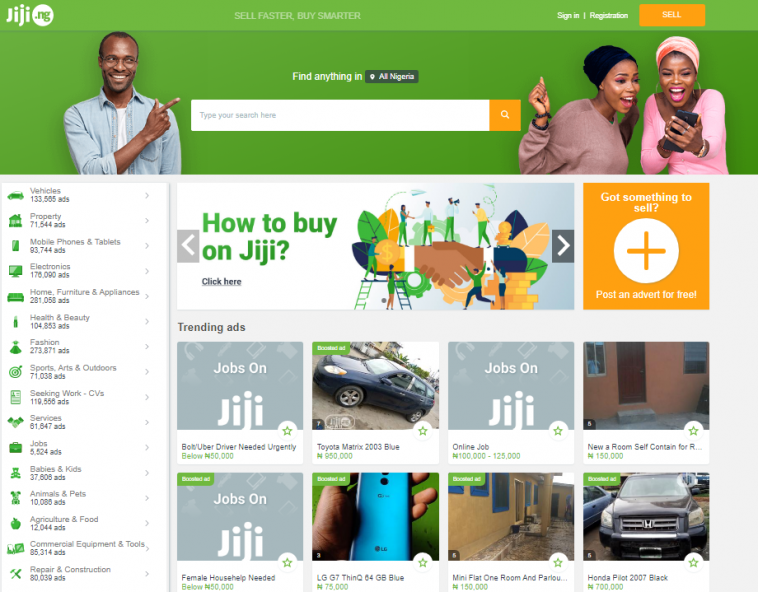

African e-commerce platform Jiji is expanding beyond the continent for the first time, planning to launch in Bangladesh, drawn by its growing middle class and increased mobile connectivity. This move underscores the company’s ambition to enter high-growth emerging markets outside of Africa. Bangladesh’s e-commerce sector is expected to reach $13 billion by 2027, according to Payments and Commerce Market Intelligence (PCMI).

Currently operating in seven African countries—Ethiopia, Ghana, Kenya, Nigeria, Tanzania, Uganda, and Senegal—Jiji views Bangladesh as a logical next step. With 131 million internet users and a growing demand for digital shopping, the South Asian nation presents the company with an opportunity to expand its 12 million monthly active users.

“With a strong financial foundation and a scalable business model, we have established ourselves as a profitable leader in Africa’s e-commerce space,” a Jiji spokesperson told TechCabal via email. “Our success in Africa has taught us how to navigate rapidly growing markets, and we believe Bangladesh holds the same potential for Jiji to thrive, contributing to the growth of the e-commerce sector.”

Bangladesh is emerging as a key player in the Asia-Pacific e-commerce market, supported by government policies aimed at promoting e-commerce growth. One such initiative is the Information and Communication Technology (ICT) Act of 2006, which provides a legal framework for online transactions and addresses cybersecurity concerns. The government has also introduced national ICT policies to guide the development of the digital economy, including e-commerce.

These policies, along with a rising middle class, have created a fertile environment for e-commerce growth. In 2024, 79% of Bangladeshi consumers shopped online, and 47% were comfortable making payments on digital platforms, according to a PCMI survey.

Jiji’s entry into Bangladesh will place it in direct competition with established players such as Daraz, Bikroy, and Ajkerdeal, which have strong brand recognition and consumer trust. To replicate its success in Africa, Jiji will need to differentiate itself through localized offerings and strategic partnerships.

Founded in 2014, Jiji initially entered Nigeria’s competitive e-commerce market by offering free listings for first-time users and partnering with phone manufacturers to preload its app on affordable smartphones. The company also struck a 2016 deal with Airtel to offer data-free access to its platform.

In 2019, Jiji raised $21 million and acquired OLX Africa, taking over operations in Nigeria, Kenya, Ghana, Uganda, and Tanzania. This move helped Jiji reach 300 million people across five countries. In 2021, the company acquired Cars45, a platform for buying, selling, and trading used cars in Nigeria, Kenya, and Ghana. The following year, Jiji acquired Tonaton, its main competitor in Ghana.

Jiji’s strategy proved successful in Africa. The company now aims to replicate that success in Asia

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?