Kenya fintech Zanifu will extend its stock financing to MSMEs after securing $1 million in seed funding. The round was funded by Saviu Ventures, Sayani Investments, Launch Africa, and other Kenyan and Nigerian angel investors. This round brings the company’s total funding to $1.2 million. In early 2020, Saviu Ventures invested in the startups’ pre-seed round. The fintech startup is now eyeing expansion in Ghana and Uganda.

Zanifu provides up to $2000 in short-term stock financing and has set its eyes on an additional 15,000 FMCG retailers within a year. Steve Biko, Zanifu COO and co-founder, and Sebastian Mithika founded the financing business a year after founding the startup in 2017. As reported in TechCrunch, the company has extended over 85,000 working capital loans valued at over $13 million to over 7,000 Kenyan businesses.

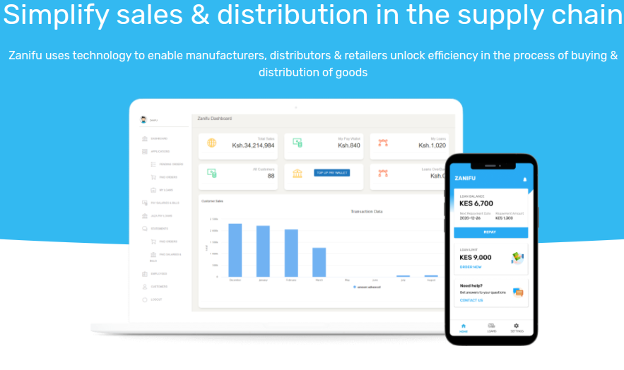

Zanifu works with manufacturers and distributors to extend this credit to small businesses. Retailers are also sourcing products from Zanifu’s partners – where they qualify for financing. Zanifu has created platforms for manufacturers, retailers, and distributors that ensure seamless ordering, payment, tracking, and fulfillment.

Borrowers get credit through the Zanifu loan app where they upload information such as historical purchase data. The retailers will then get a credit limit -within six hours of signing up and successful algorithm scoring.

Source: TechCrunch