The high number of low-income earners is gradually increasing making startups, fintech and Sacco move their operations to mobile money platforms. According to data from Google’s search engine, many Kenyans have been searching for quick mobile and low-interest loans for almost a year. Information about unsecured credit through the phones was the second most searched item.

The non-financial banking technology seemed to be embraced by a good number of populations as compared to the traditional banking ways. Cases where Saccos and banks tend to demand securities before issuing small loans; fintech tends to be more lenient not to ask for security for loans that are between KSh500 and KSh20, 000 given through mobile devices.

Competitions Authority of Kenya carried out a study that shows how Individual’s social media accounts with mobile money transaction are used to show an individual’s worth. As much as the study is yet to be made public, people have alluded to the fact that some private investments could be paying to get individual’s mobile money account without their knowledge.

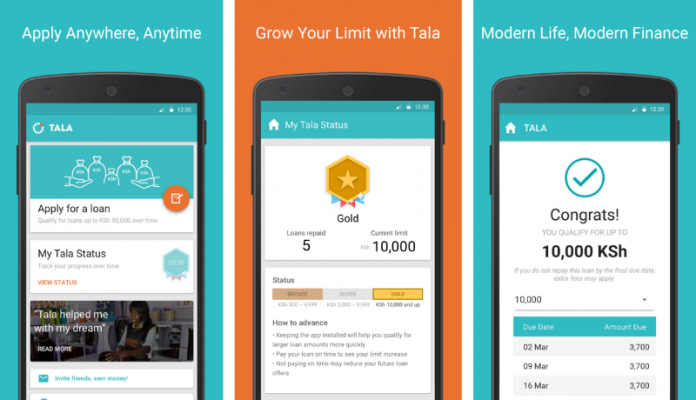

Central banks to loosen regulations to promote technological innovation which promotes financial inclusion have been key to the growth of fintech startups. From the research done by Google, it was noted that the non-banking institutions like Tala, Saida, and Branch were the reliable loan apps. The growing number of the mobile phone owners in Kenya has made all the money lenders to develop their app and mobile platforms to accommodate the current changing banking trends.

It has been noted that there has been an increase in the internet usage by Kenyans who are aged 16 years and above which is an increase by 46% from 2016. South Africa internet usage is at 65% while Nigeria 63% this according to Google ’s Communications, Public Affairs Manager for East and Francophone Africa.

The growth on the internet shows that Africa is on the verge of improving the growth come 2018. However, CBA Bank blamed the slow growth witnessed in 2017 to the stiff competition from various fintech. There were talks to have loan free slash that helps borrowers with good credit history on their M-shwari platform that presently have 18 million clients. The microloan space has made some banks in the country adjust to accommodate the high population like there is Equity’s Eazzy Banking, Co-op Bank MCo-op, and KCB M-Pesa.

According to a report by City analyst released on 8th December 2017, acceptance of cashless transactions has increased with Sh252 billion transacted from January to September 2017 with Safaricom having control of up to 74.17% as at June 2017. The Pesalink the interbank online platform moved Sh15 billion within the period.