Kenya fintech Kwara offering digital banking solutions to Saccos, has partnered with local insurtech startup Lami Technologies. The partnership will provide members of the Savings and Credit Co-operative Society (Saccos) with affordable yet transformative insurance products through its digital platform. Sacco members will conveniently access innovative insurance products in life, general, health, business, and property coverage sectors.

“This partnership speaks to our wider strategic goal to help existing credit unions and savings cooperatives transform into modern digital financial institutions. We believe that providing access to insurance products through the Kwara app will fast-track members into a path of financial independence and strengthen their ability to withstand financial shocks,” Cynthia Wandia, co-founder/CEO.

“We are proud to partner with Kwara to introduce affordable insurance products to SACCO members and empower Kenyans with a fast, simple, and quick coverage option that contributes to a more inclusive ecosystem. By harnessing the power of technology and collaborating with market leaders to roll out equitable solutions, we are fulfilling our mission to provide coverage to millions of underserved Kenyans. This collaboration is a significant milestone for both organizations, and will help shape a new digital age for the insurance ecosystem.” Jihan Abbas, co-founder/CEO, Lami.

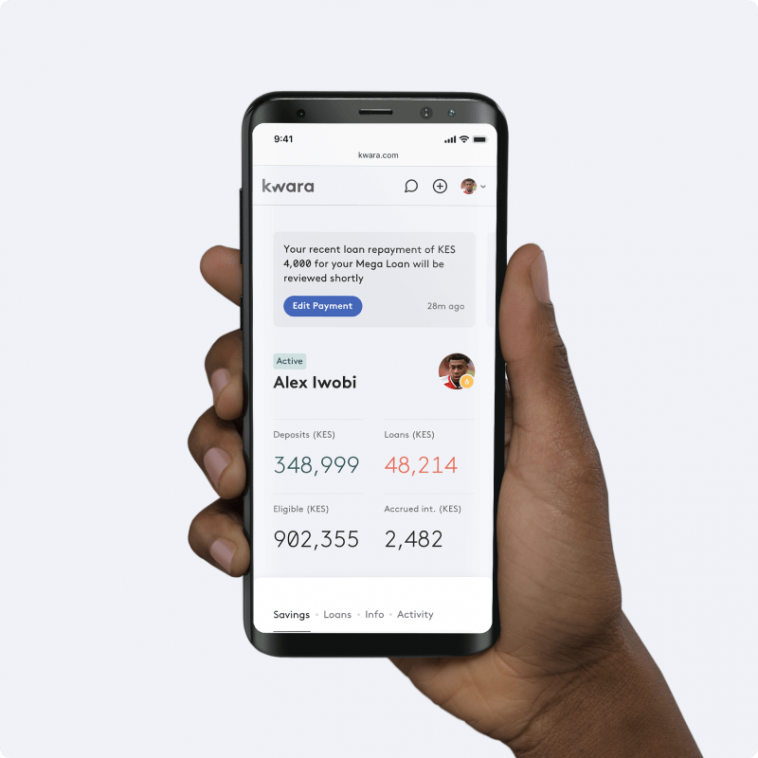

Kwara was one of the 5 startups to participate in the first cohort of the 2021 Japanese-led NINJA Accelerator and also formed one of the 2 startups representing Africa at the Mastercard Start Path programme. This new partnership will see Kwara’s over 60,000 members easily access products tailored to certain needs, offered through the neobank app which is in turn integrated with Lami’s insurance technology infrastructure.

We earlier shared how Lami Technologies raised $1.8M to scale its insurance API platform, in addition to a recent strategic partnership with Sendy.