Going by the size of the population, Africa is the fastest growing banking market globally. The continent is also a cornerstone for the growth of the companies’ market allowing them to attend to unique needs of people. The continent which was once referred to as the Dark Continent is being revolutionized. Moreover, it possesses a strong potential than compared to way back before. Access to financial tools is the best way of reducing poverty. It used to be only accessible through bank accounts at a local bank in the past. But the evolution of M-Pesa has changed the whole notion of a bank. It has helped to cater for the less privileged individuals and offering solutions to the renowned challenges in Africa. These are challenges like HIV treatment and access to health, especially for women.

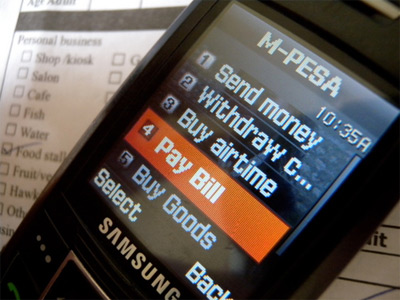

M-Pesa is a mobile banking service that offers its users a chance to store and transfer money using their mobile phones. This helps to do away with a conventional bank account for daily transactions. Currently, the platform has 32 million users across Africa. This lists it as the largest mobile money platform in Africa. In the previous financial year, Vodacom international markets transacted R25 billion monthly. On the other hand, Kenya alone transacted R85 billion. Safaricom is the leading mobile service provider in Kenya. The population in that country is largely using M-Pesa for their mobile money services. The main stimulant to the growth is to make more people access to mobile connectivity and mobile phones.

There is an increase in the number of people with bank accounts. This is mainly in Tanzania, and M-Pesa has been a critical player to the growth. By now 6.4 million people in Tanzania are using M-Pesa. The figure is almost half the number of Vodacom subscribers. Furthermore, M-Pesa is where M-Pawa was developed from, and it allows Tanzanians to access loan and saving facilities. Vodacom came up with Lipa-Kwa, a payment solution that offers customers a chance to transact with M-Pesa in Tanzania. Vodacom collected revenue worth $160 million in 2018 through M-Pesa and other financial tools associated with it. The country is the major exporter and producer of spices and coffee respectively. The growth of its economy is supported by the population that is more financially savvy. Around 37% of the country’s GDP passes via M-Pesa platform which boosts the Tanzanian’s economy.

The economy of Lesotho relies significantly on subsistence farming it can most benefit from a population that access financial tools and M-Pesa are also playing a vital role in the country. The country has so far recorded 30% penetration of mobile financial services. M-Pesa has managed to meet some customer’s needs by making sure that the citizens can carry out huge payments for services like school fees. The platform ensures users’ security by allowing confirmation, and it also allows its users to possess beneficiary list. Another country that has so far benefitted from the innovative platform is Mozambique. The country has a total of 3.1 million users of M-Pesa its citizens are now accessible to loans through a partnership between M-Pesa and two commercial banks in the country. DRC has 1.8 million customers of M-Pesa allowing them to trade in Forex, access loans, savings and to make purchases of tickets in local leagues.

The platform is thinking ahead of other mobile financial service providers in Africa to solve the significant problems faced by a lot of Africans. The platform has put up an initiative to protect mothers in Africa. Moreover, it is allowing healthcare organizations like Comprehensive Community Based Rehabilitation to transfer money for bus fare to healthcare facilities for women affected by obstetric fistulas. More than 55 million SMS has been sent out to support the initiative. Furthermore, 400 M-Pesa ambassadors have been fully trained to be part of the initiative. It has so far benefitted more than 3,200 Tanzanians from rural areas. The Basotho can also access healthcare services through M-Pesa. This happens by giving out vouchers giving patients a chance to access healthcare facilities with more than 150,000 HIV tests are taking place.

The platform is empowering Africans who have various and unique needs. Almost $2 billion is collected every month through M-Pesa. By 2025 the household consumption in the continent will be at $2.1 trillion. The question that comes from that is on how Africans can consume the amount and if the continent can come up with innovative ways for it. The continent has to rethink how to empower its population financially given that many of them do not have bank accounts. Moreover, the continent should maximize on the increase in penetration of mobile access. M-Pesa has worked its way into the market by making sure that future clients have access to the platform through ensuring that Africans possess mobile phones. Facebook is also following the same lane by developing improvised markets, new subscribers and have access to internet connectivity. M-Pesa can transact $1.9 million every month which has taken different forms in every country of its operation.

It is in the records that Grameen Bank founder and Nobel Prize holder Muhammad Yunus revolutionized the country using his micro-loan facilities in Bangladesh. This proved how strong micro-loans is. M-Pesa has ensured financial inclusion in communities that might not have accessed financial services. The platform is playing a vital role to address the sustainable development goals by United Nations.