Chari has announced a closing bridge round led by Khwarizmi Ventures (KV), a Saudi-based venture capital fund, AirAngels, and AKWA Group’s venture capital arm Afri Mobility. The bridge round will usher the new participants in joining the existing cap table that includes Rocket Internet, Y Combinator, Plug n Play, Global Founders Capital, Village Capital, Harvard University Management Company, P1 Ventures, and others.

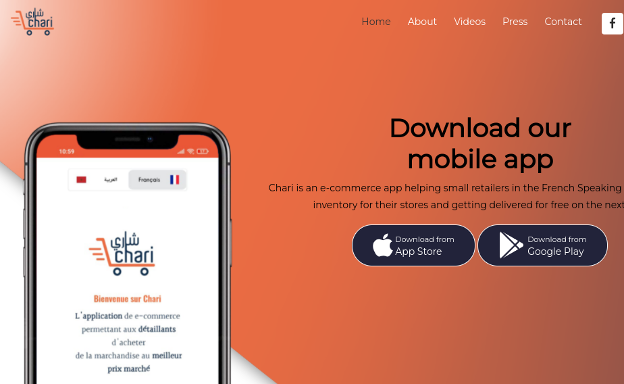

Chari, a B2B e-commerce and fintech startup, is working to digitize the largely fragmented FMCG sector across francophone Africa. Traditional convenience stores across Tunisia and Morocco can order products through Chari App, and receive them in less than 24 hours.

Chari is a recent graduate of the Y Combinator Summer 21. The company was founded in January 2020 by Sophia Alj and Ismael Belkhayat. Last year the startup announced a $5 million seed round with the acquisition of Moroccan startup Karny.ma. The acquisition of the Moroccan credit book app gives Chari valuable data on loans given by grocery stores to their customers. This in turn allows Chari to credit-assess unbanked shop owners while determining the most fitting payment terms given to each.

Chari CEO Ismael Belkhayat said that the company will use the bridge round to test the BNPL services with its existing customers. Upon getting successful results Chari will then acquire a local company that enables shop owners to lend money to their end-users while further growing the business.

Source: Wamda

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?