Mtor, an Egyptian online marketplace for auto parts, has secured $2.8 million in pre-seed funding, with leading support from Egypt-focused venture capital firm Algebra Ventures. The funding round also saw participation from notable investors such as the Dutch Founders Fund (DFF), Aditum Ventures, LoftyInc Capital, and various local and global angel investors, per the company’s official statement.

Founded in April 2022 by Mohamed Maged, who draws inspiration from his extensive experience in the automotive sector gained during his time in Germany, Mtor aims to revolutionize the auto parts industry. Maged, having previously held vital expansion roles at the B2B e-commerce marketplace MaxAB upon returning to Egypt in 2020, embarked on the journey to establish Mtor.

In a TechCrunch interview, Maged discussed his recognition of a significant challenge in addressing inefficiencies and fragmentation within the auto parts supply chain and the automotive aftermarket. His focus was explicitly on local workshops and car mechanic spaces. Maged stated, “I got the idea for Mtor before coming to Egypt. I worked in the automotive industry and observed the inefficiency of global suppliers who lacked knowledge about local workshops or service providers. With Egypt not manufacturing many spare parts, a substantial information and technical gap exists, not just in distribution but also concerning new products.”

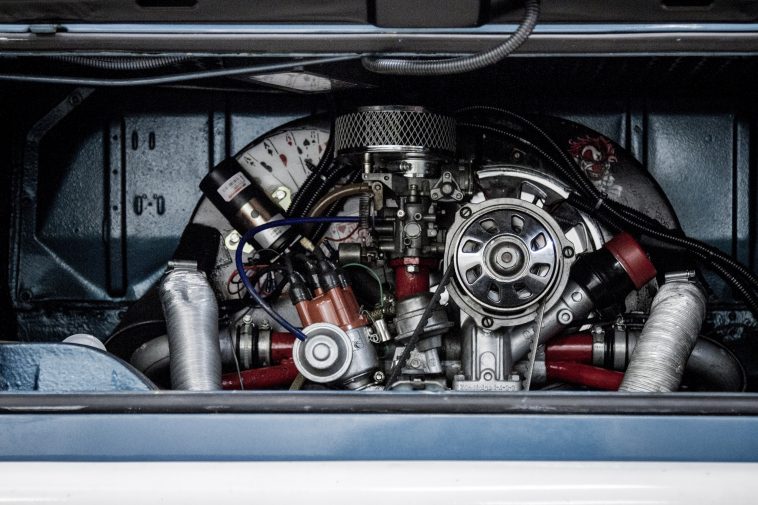

Mtor, led by Maged, CTO Khaled Kandil, COO Mohamed Altaf, and V.P. of Strategy Moaz El Megharbel, initially concentrated on providing spare parts to nearby workshops and overseeing logistics. Gradually, the company broadened its activities, establishing collaborations with importers to streamline distribution in the Egyptian market, which hosts numerous local service providers and millions of cars requiring maintenance and aftersales parts.

Egypt’s automotive after-sales market stands as one of the largest in Africa and the MENA region, boasting a value surpassing $5 billion. With an ageing fleet of 8 million vehicles, car owners dedicate an average of over $600 annually across 35,000 workshops and service providers. This highlights the significant untapped potential within Egypt’s automotive after-sales sector.

Mtor, at its core, addresses the challenges these local workshops face, tackling issues such as inaccurate fitment data, logistical obstacles, parts availability, and price transparency. The startup aims to fill the gap for car owners caught between official dealerships, where prices are two to three times higher, and local workshops providing more budget-friendly alternatives. Despite potential quality concerns at local workshops, especially amid global economic challenges, Mtor acts as a mediator, utilizing a tech platform to connect these workshops directly with importers.

Mtor streamlines the conventional supply chain process where importers typically supply bulk orders to large wholesalers, who then distribute to local mechanics through multiple supplier layers. In contrast, Mtor offers a more efficient pricing model than the traditional two-layer supply chain.

According to Maged, a representative from Mtor, local mechanics can acquire parts through the current supply chain for 10,000 Egyptian pounds. However, opting for Mtor enables them to obtain the same parts for a reduced cost ranging from 8,000 to 8,500 Egyptian pounds. This cost advantage is attributed to Mtor’s optimized supply chain, connecting importers directly to Mtor’s two warehouses in Cairo and Giza, and subsequently delivering to mechanic workshops.

Maged emphasizes that Mtor operates as an intermediary, leveraging a tech platform to link workshops with importers directly. This approach enhances efficiency and ensures the availability of high-quality and reliable parts. The goal is to balance traditional and tech-driven worlds, providing workshops with improved access to parts while offering logistics and on-demand product delivery.

Mtor, an online auto parts marketplace in operation for two years, employs a margin model closely linked to the parts it offers. Operating on standardized pricing, the business derives its margins from this pricing structure, including free delivery.

Over the preceding 18 months, Mtor has successfully served more than 2,500 workshops, fulfilling a commendable 70,000 orders. The company has established partnerships with over 60 importers on the supply side.

Beyond functioning as a tech-driven distribution channel, Mtor has implemented a robust feedback loop that integrates data, parts information, and pricing points. The Mechanic app, tailored for local workshops, streamlines the ordering process and provides valuable insights into compatible aftersales parts. Additionally, the app efficiently manages the redirection of parts, whether to Mtor’s inventory or the importers’ stock, thereby enhancing collaboration and efficiency within the automotive aftermarket.

Mtor’s strategic emphasis on B2B clientele sets it apart from platforms acting as intermediary marketplaces connecting vehicle owners with service providers. One prominent instance is Odiggo, a YC-backed Egyptian startup that originally functioned in this realm but subsequently transitioned to Sully.

A.I. is a specialized A.I. team automating healthcare tasks. Similarly, Mecho Autotech, a Nigerian auto deals marketplace, initially operated in the business-to-consumer sector before recently diversifying into wholesale distribution of aftersales parts.

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?