Avo is Nedbank’s latest digital platform that connects customers with products and services online. According to the financial institution, the platform was launched during the COVID-19 pandemic to give customers a virtual environment to purchase items online. Nedbank believes the app would benefit customers, given their use of artificial intelligence, bank-grade security, and secure payment.

Product and Services Available in Avo

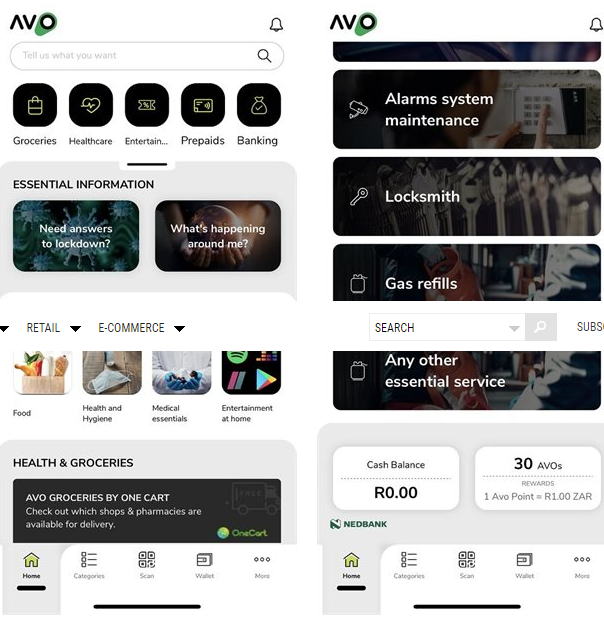

Currently, there are several products and services in Avo from various merchants. These include online grocery shopping, essential professional home repair and services, locksmiths and alarm system maintenance, and digital home entertainment services such as Showmax and Deezer.

The newly launched app is called a “super app” for a good reason. It consists of various apps compressed into one to make life easy for users.

The Nedbank retail and business managing executive, Ciko Thomas, commented that today’s banks must deliver other services beyond financial services to their customers. He says banks can deliver value to customers via platform ecosystems.

Launching Avo to the public

Nedbank launched Avo during the lockdown to 30,000 staff members. Because of that, the bank has decided to reposition the offering of the app to become Level-5-compliant. Consequently, Avo’s beta version has been a joy to use. Currently, diverse provinces have access to essential goods, home entertainment, and home service providers via the platform.

However, Avo’s public launch is pending, with no date in sight. But Nedbank Money App customers can sign up and use the beta version. Avo has recorded a total of 5,000 customers, and over 170 home repair and service merchants have signed up on the app.

Ciko Thomas concluded by saying, and I quote, “We at Nedbank know that having the capacity to add massive value to all areas of an individual’s business and life is what makes any platform ecosystem noteworthy. He also added that Avo, a super digital platform, will make Nedbank more than just a bank.

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?