African startups kicked off 2025 with remarkable funding momentum, securing $289 million in January despite the month’s traditional reputation for sluggish investment activity. Data from Africa the Big Deal reveals this represents a dramatic 240% increase compared to January 2024, when startups raised only $85 million.

This impressive figure makes January 2025 the second-strongest opening month since 2019, trailing only January 2022’s $400 million raised during the peak of the funding boom. The recent performance signals renewed investor confidence in African tech ventures after several challenging years.

Forty African startups raising at least $100,000 contributed to January’s total. Though this number falls below deal volumes seen in January of previous years, the quality of deals improved substantially. Twenty-six startups secured at least $1 million each – more than any January except 2022.

Equity funding dominated the investment landscape, accounting for $262 million (90.6%) of January’s total. This quadruples the equity investment seen in January 2024 and represents the second-highest January equity funding since 2019. The shift toward equity funding reverses a recent trend where investors preferred debt financing amid global inflation concerns and numerous startup failures.

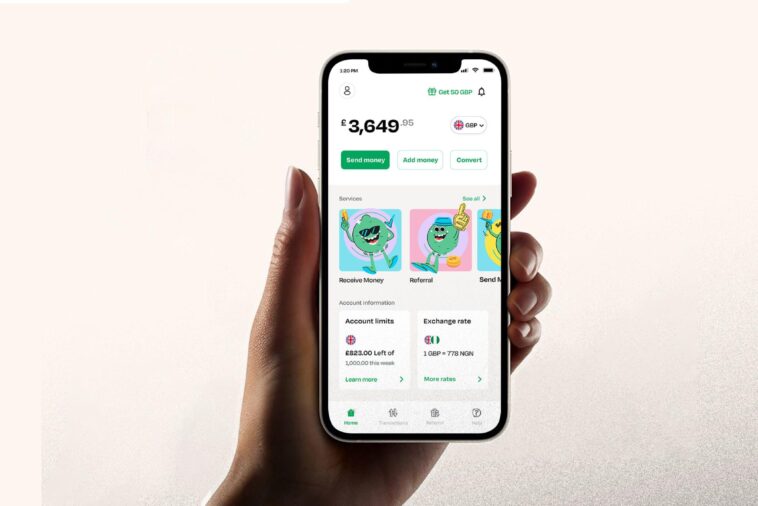

Nigerian fintech LemFi led the month’s fundraising with a $53 million Series B round aimed at expanding its remittance services into European and Asian markets. Kenya’s PowerGen secured the second-largest investment at $50 million, earmarked for developing renewable power projects across Nigeria, Sierra Leone, and the Democratic Republic of Congo.

The strong equity component of January’s funding suggests investor confidence may be returning after successive years of decline. African fintech startups experienced a 25% drop in equity funding during 2024, but this represented the slowest rate of decline since the sector’s peak. Previous years saw more dramatic pullbacks – equity funding fell 27.2% in 2023 and 35.3% in 2022 from preceding years.

January’s total does show a 15% monthly decrease from December 2024’s $340 million figure. However, the year-over-year comparison paints a much more encouraging picture for the African startup ecosystem, potentially indicating a positive turning point after the funding winter.

The resurgence of equity investment over debt financing suggests investors may be regaining faith in African startups’ long-term growth potential. This renewed confidence comes after two difficult years where startup failures and global economic uncertainty dampened enthusiasm for the African tech sector.

Source

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?