Ride-hailing apps are transforming transportation in Africa, with companies like Bolt, Uber, Yango, SafeBoda, and Gokada addressing urban mobility challenges. Here’s what you need to know:

- Market Growth: Africa’s ride-hailing market is expected to grow from $4.2B to $7.8B by 2030.

-

Key Players:

- Bolt: 21% market share, operates in 30 cities, offers services like motorcycle taxis.

- Uber: 16% market share, focuses on tech-driven solutions like electric vehicles and premium services.

- Yango: 14% market share, strong in West Africa, combines ride-hailing with delivery services.

- SafeBoda: Motorcycle-focused, prioritizes safety and digital payments in East Africa.

- Gokada: Nigeria-based, diversifying into logistics and food delivery.

- Economic Impact: These platforms create jobs, improve transport efficiency, and support local economies.

Quick Comparison:

| Company | Market Share | Key Strengths | Challenges |

|---|---|---|---|

| Bolt | 21% | Wide operations, tailored services | High competition, costs |

| Uber | 16% | Global experience, tech focus | Adapting locally, regulations |

| Yango | 14% | Competitive pricing, delivery | Limited regions, regulations |

| SafeBoda | N/A | Motorcycle expertise, safety | Informal competition |

| Gokada | N/A | Diversified services, partnerships | Strict regulations |

These companies are reshaping mobility with tailored solutions, despite challenges like infrastructure and regulatory hurdles. Dive deeper to learn how each is driving change across Africa.

Cameroon ride-hailing app provokes taxi drivers’ ire

1. Bolt

Bolt has become a key player in reshaping transportation across Africa. It operates in 30 cities across six African countries, using advanced data tools to streamline routes and reduce wait times – tackling the traffic challenges common in urban areas [4][1].

The company tailors its services to local needs, offering options like motorcycle taxis in Kenya and Uganda [4]. This approach gives Bolt an edge in areas where traditional transport options are limited or less practical.

Bolt also plays a major role in Africa’s gig economy by creating jobs for drivers. With the shared mobility market expected to double by 2030, Bolt’s growth aligns with the rising demand for convenient and accessible transportation [5].

To improve safety and navigate regulatory hurdles, Bolt works closely with local authorities. These efforts help build trust with both users and regulators [1].

Although Bolt leads in many areas, it faces competition from Uber, which brings its global experience to the African ride-hailing market.

2. Uber

Uber has been a key player in Africa’s ride-hailing market since 2013. Operating in countries like South Africa, Nigeria, Kenya, and Ghana, the platform connects millions of riders with tens of thousands of drivers across Sub-Saharan Africa [3].

The company tailors its services to meet local needs. For example, it offers UberBoda motorcycle taxis in East African markets and premium options like Uber Comfort and Uber XL in select areas [3].

Uber is among the top three ride-hailing services in eight African countries and holds the leading position in Egypt [1][3]. The company is also exploring electric vehicles in South Africa, introducing Teen Accounts to expand its user base, and rolling out app updates to improve service efficiency [3].

By combining technology with modern transportation solutions, Uber addresses urban mobility challenges while providing income opportunities for drivers. This aligns with predictions that Africa’s shared mobility sector will grow from $4.2 billion to $7.8 billion by 2030 [5].

To navigate local regulations and market-specific hurdles, Uber employs strategies designed for long-term operations [4]. While Uber benefits from its global experience, competitors like Yango are also making strides in Africa’s ride-hailing industry.

3. Yango

Yango operates mainly in West and Central Africa, offering transportation services in countries like Côte d’Ivoire and Senegal. Using its app, the company blends ride-hailing with last-mile delivery, offering a more efficient option compared to older transportation systems [3].

In February 2023, Yango temporarily halted services in Cameroon due to regulatory issues [1]. Despite this, the company managed to continue operations in other regions, demonstrating its ability to handle challenges while staying active in the African market.

Yango focuses on bridging gaps in public transportation through technology, while also creating job opportunities [3]. This strategy has helped it become the third-largest ride-hailing service in Africa, especially in areas where dependable transportation is hard to find.

sbb-itb-dd089af

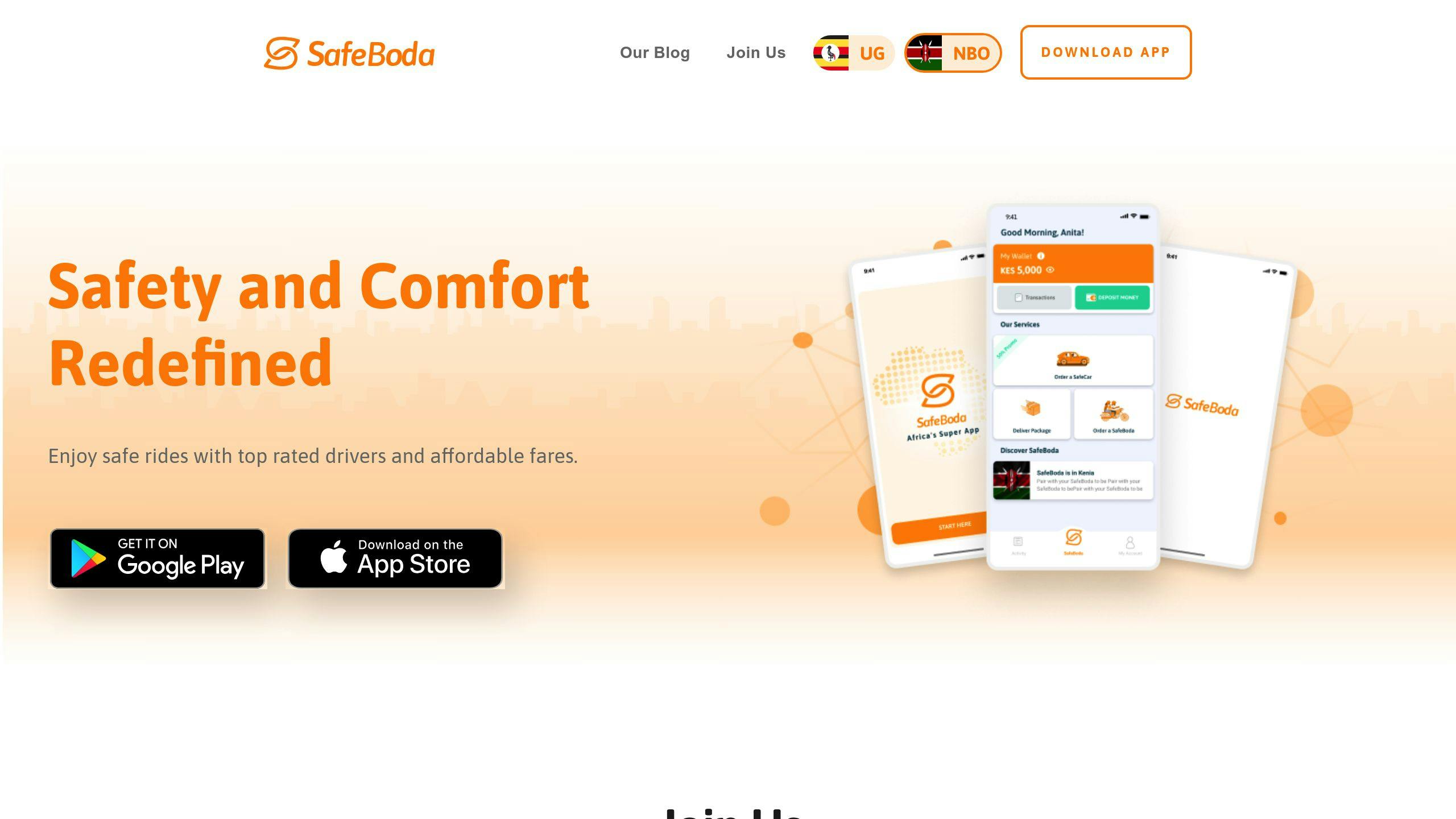

4. SafeBoda

SafeBoda is a motorbike hailing platform that started in Uganda and now operates in Uganda, Kenya, and Nigeria [2][4]. It focuses on transforming the "boda boda" (motorcycle taxi) sector, traditionally informal, by introducing a mobile app for booking rides, real-time tracking, and digital payments [2].

The company prioritizes safety with features like thorough driver vetting, real-time ride tracking, in-app emergency support, and secure payment methods. These efforts have helped SafeBoda attract major investments, including a Series B funding round led by Allianz and Go-Jek, fueling its growth across Africa [4].

By formalizing motorcycle taxi services, SafeBoda not only provides drivers with steady incomes and access to financial tools but also supports local economies [2][4]. Although it faces challenges like regulatory issues and competition from informal operators, the company works closely with local authorities and tailors its approach to fit each market [2].

Similarly, Gokada has used motorcycle taxis to tackle urban transportation issues in West Africa.

5. Gokada

Launched in 2018, Gokada has established itself as a prominent motorcycle ride-hailing platform in Nigeria, playing a key role in reshaping urban transportation across Africa.

Through its mobile app, Gokada has streamlined traditional motorcycle taxis by enabling ride booking, real-time tracking, and digital payments. In 2019, the company secured $5.3 million in funding to support its growth and expansion efforts [4].

Despite facing challenges from strict regulations in Lagos State, Gokada adjusted its approach by branching out into areas like food delivery, logistics, and other commercial services. These moves, along with partnerships within local markets, have helped the company solidify its position [4].

Looking ahead, Gokada aims to expand into East Africa, applying its existing operational model while tailoring it to fit the unique needs of new markets [4]. Beyond transportation, the company plays a role in local economic growth by creating jobs and offering cost-effective urban mobility. Its integration of digital payments and formalization of the motorcycle taxi industry also support Africa’s broader shift toward digital solutions in transportation.

Gokada’s journey reflects the adaptability of Africa’s ride-hailing startups, which continue to find ways to thrive despite regulatory hurdles and market pressures.

Advantages and Disadvantages

Africa’s ride-hailing market is full of potential, but it’s not without its hurdles. Companies in this space rely on their strengths while tackling specific challenges unique to the region.

Market Leaders’ Comparison

| Company | Key Strengths | Main Challenges |

|---|---|---|

| Bolt | – Dominates with a 21% market share [1] | – Infrastructure issues |

| – Operates across multiple countries | – Intense competition | |

| – Offers a variety of services | – High operating costs | |

| Uber | – Strong global brand recognition | – Holds a smaller market share (16%) [1] |

| – Leading in Egypt | – Struggles with adapting to local markets | |

| – Advanced technology [3] | – Faces high regulatory costs | |

| Yango | – Leading in West Africa | – Regulatory challenges [1] |

| – Competitive pricing strategy | – Limited regional presence | |

| – Infrastructure weaknesses | ||

| SafeBoda | – Deep understanding of local markets | – Restricted to specific regions |

| – Expertise in motorcycle transport | – Informal competition | |

| – Offers additional services like payments [2] | – Safety concerns | |

| Gokada | – Unique business model and multiple revenue streams | – Faces strict regulations |

| – Strong partnerships [4] | – Regional limitations | |

| – Market instability |

Despite their differences, these companies collectively drive the growth of ride-hailing across Africa.

Economic Impact Analysis

The ride-hailing industry in Africa is expected to grow significantly, from $4.2 billion to $7.8 billion by 2030 [5]. This growth is fueled by:

- Job creation and providing dependable transportation services [3]

- Companies like SafeBoda and Gokada diversifying into logistics and food delivery [2][4]

These contributions underscore how ride-hailing is shaping Africa’s economy, offering a mix of employment opportunities and enhanced mobility.

Regional Success Factors

What sets successful companies apart? A few common traits stand out:

- Tailored services and digital tools that improve efficiency and meet local needs

- Diverse payment methods and service offerings to cater to different customer bases

- Building strong relationships with regulators and local communities [2]

These factors not only help companies thrive in Africa’s competitive market but also ensure they stay relevant in a complex and evolving landscape. The key to long-term success lies in balancing new ideas with practical solutions tailored to the continent’s unique challenges.

Conclusion

Africa’s ride-hailing market is on track to reach $7.8 billion by 2030 [5], fueled by rapid urban growth and an expanding middle class seeking efficient transport options.

Both global and local companies are shaping the industry’s future in distinct ways. Bolt stands out with its extensive operations across the continent, Uber pushes boundaries with its tech-driven approach, and Yango holds a strong foothold in West Africa. At the same time, local companies like SafeBoda and Gokada show how a deep understanding of local needs can lead to growth through tailored services.

"Shared mobility is already set to rise from 3% to 7% of journeys by 2030", says Dr. Andreas Nienhaus, partner at Oliver Wyman [5].

As ride-hailing apps become a go-to option for affordable transport in regions where car ownership is less common, the market’s potential continues to grow. With about one-third of Africa’s population already using these services [3], the groundwork for further expansion is firmly in place.

The future success of this sector will hinge on finding the right mix of technological progress, regulatory alignment, and solutions tailored to local challenges. Companies that can balance these elements will thrive in Africa’s fast-changing ride-hailing landscape.

Related posts

- 10 African Tech Investors to Watch in 2025

- African Tech Hub Comparison: Lagos vs Nairobi vs Cape Town

- How Mobile Social Platforms Drive African Startups

- Top 7 African Tech Hubs Building Communities

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?