VerPay, a telephonic payment solution, just launched ‘verbal commerce’ as part of their innovative adjustment towards the Covid-19 pandemic. This itself renders the payments landscape useless for innovation. VerPay allows merchants to conduct their businesses while speaking to customers. This is ideal for the lifestyle, retail, health, travel, hospitality, and financial services industries.

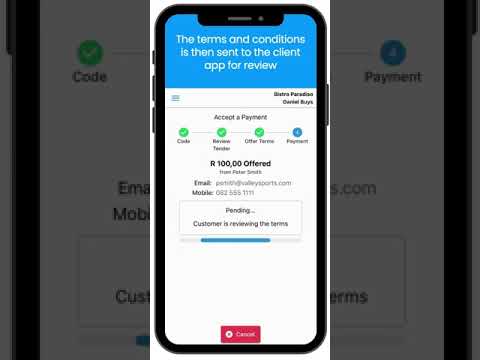

Merchants inform the customer of the amount owed via phone, an amount entered into VerPay’s user-friendly web app. A shortcode is generated on the screen in which the customer reads out to the merchant. That helps in the verification of the transaction details. The customer reviews before accepting the terms and conditions assigned by that merchant. Both parties get notified when the payments are processed.

According to the press release, Dana Buys, the CEO of VerPay Pty Ltd, pointed out how there has been a need to conduct business over the phone but faces lots of challenges from fraud. She went on to describe Verapay as a “highly secure solution” that can be exploited by companies with a “telesales of field sales force.”

How does verapay work?

The Cape Town fintech works with mobile payment methods such as NetCash, Zapper, Stripe, Snapper, and MasterPass.

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?