South Africa-based healthtech startup HealthLeap has raised a $1.1 million pre-seed to reduce cases of malnutrition and in hospitals through the use of a clinical assisted AI assistant. The company has set its eyes on solving the prevalence of malnutrition among hospitalized patients in the United States through an automated clinical assistant. The raise was led by San Francisco-based Fifty Years – a deep tech investor. This investment will go towards hiring software engineers and data scientists who will continue using smart tools to assist clinicians prevent and treat malnutrition in hospitals.

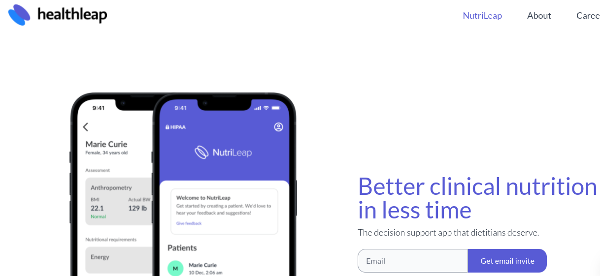

HealthLeap is currently building AI-assisted tools for healthcare professionals to use in the hospitals. Simply put, the startup provides a clinical assistant for dietitians. Launched in April 2021, the startup is run by Jemima Meyer the Chief Research Officer, Josiah Meyer CEO, and Ray Botha CTO.

NutriLeap is the company’s AI-assisted clinical product, and HIPAA-complaint mobile app helping hospital dietitians with automated clinical calculations and research-backed suggestions. TechCrunch shares that the app is currently used by 50 dieticians on a private beta program and has a waitlist of over 1,000 dietitians, pharmacists, and physicians. Speaking to TechCrunch Josiah Meyer shared the company’s desire to, “make nutrition data-driven for everyone” while narrowing on “hospital patients” as their first stop.

HealthLeap is poised to capture the market share with its software after the newly approved USDI standards allow healthtech organizations greater access to health data sources. Despite being in its pre-revenue phase, it expects to transition smoothly into a paying service as its own pricing research shows 97% of its targeted users are willing to pay out-of-pocket monthly subscription fees.

Now operational for 7 years, Fifty Years has built an impressive portfolio of deep tech companies and only last year raised its third $90 million fund. The fund has impressively stacked 44 unicorn founders who offer advice in addition to having a vested interest.

Source: TechCrunch

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?