Customers do not influence the financial markets. Financial institutions and banks have the final say on making financial purchases. Moreover, customers cannot control their transaction needs since they lack financial power. The only customers who can ask for better purchases are those with good status with the bank. What of the common customers whom the only relationship with the bank is carrying out transactions? The answer is obvious that they will have to settle for anything that comes their way. This is what MoolahGo is aiming to lavage.

MoolahGo launched the first e-Marketplace in South East Asia. Their services that were launched allow users to be both suppliers and buyers during the financial services transactions. MoolahGo will only be acting as an intermediary to ensure efficiency of transactions. The Fintech industries have been fighting against the old day’s financial systems. Moreover, MoolahGo is on the verge of disturbing it further. MoolahGo is looking forward to changing how transactions take place. Besides, it aims at giving businesses and consumer’s power over their transactions.

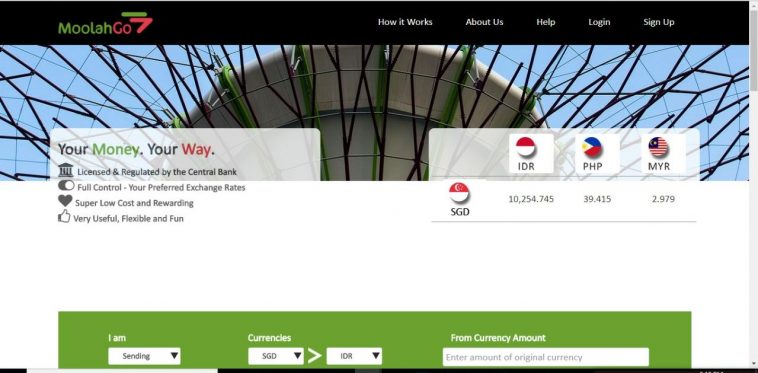

Monetary Authority of Singapore (MAS) regulates and gives license to the startup. MoolahGo took many years to plan, organize and research before launching their website. The website www.moolahgo.com came to be in Singapore on January 23, 2018. The platform first launched Cross-border Payments and Currency-exchange. Those are the two financial products that it launched first. Moreover, it plans to launch its third product called eMulti-currency Payments soon.

MoolahGo has deployed the use of technology to make money changing process convenient. Members can also carry out transactions online. Therefore, customers can access money in different ways. This can be by cash or bank deposits. Moreover, they have made it possible for customers to exchange currency at any rate. Besides, market rates play a key role and one should watch out these. The platform is trying to do away with the process of queuing to exchange their currencies.

Currently, MoolahGo delivers its payment services from Singapore to Indonesia. However, they hope to expand their services to many countries in Asia in the next one year. The ability of customers to have the final say in their transactions makes the startup unique. This is as compared to other Fintech that make the final say in any transaction. MoolahGo’s multi-currency Payments service will change the way e-commerce payment is done. A good number of people are happy about the eMulti-currency Payments service. They are eagerly waiting for the launch.

Brains behind the development of the startup have experience in technology and banking. Mr. John Hakim who is the CEO and Founder has been in the banking industry for more than 15 years. He has also worked with Accenture for clients for five years. He was also a COO at the lending product for Credit Suisse in APAC. Lastly, Mr. Hakim worked with JP Morgan Chase. The company is aiming to develop more financial services before the end of 2018. The company is currently working on ideas for investment and insurance. It hopes to roll them out in their marketplace.