TechInAfrica – Most of the people living in the modern era—me included—are involved and affiliated with so many stuffs that we couldn’t keep track where our money comes from and goes to. Sometimes, even, it feels like our money is coming back significantly slower than it initially came out; this makes budgeting and financial management harder in the midst of subscriptions, electricity/phone bills, credit card purchases, or even our daily needs like groceries. Saving for your retirement seems near-impossible if you can’t manage your wallet properly.

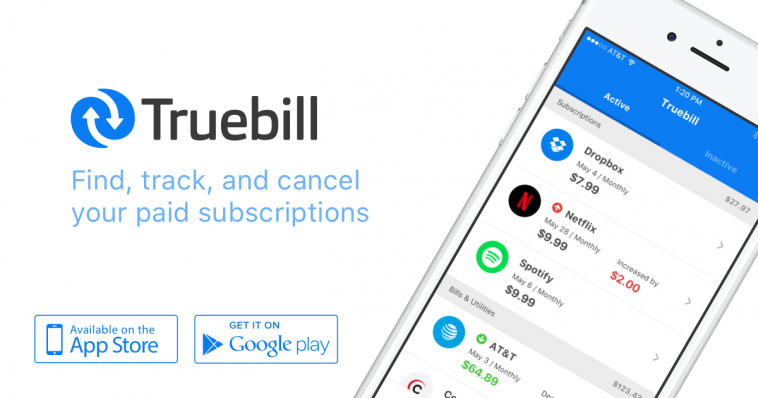

Thankfully, Truebill—a smartphone app available for both Android and iOS—makes it easier to ‘optimize your spending, manage subscriptions, lower your bills, and stay on top of your financial life.’

Truebill, supported by renowned companies like TechCrunch and Forbes, uses bank-level security with 256-bit SSL encryption and read-only access. Meaning; users wouldn’t need to worry about having their private financial data breached by unwanted hackers or other malicious threats.

Cited from their official website:

We use Plaid to securely connect to more than 15,000 financial institutions across the U.S. During the registration process, you will be asked to enter your online banking credentials.

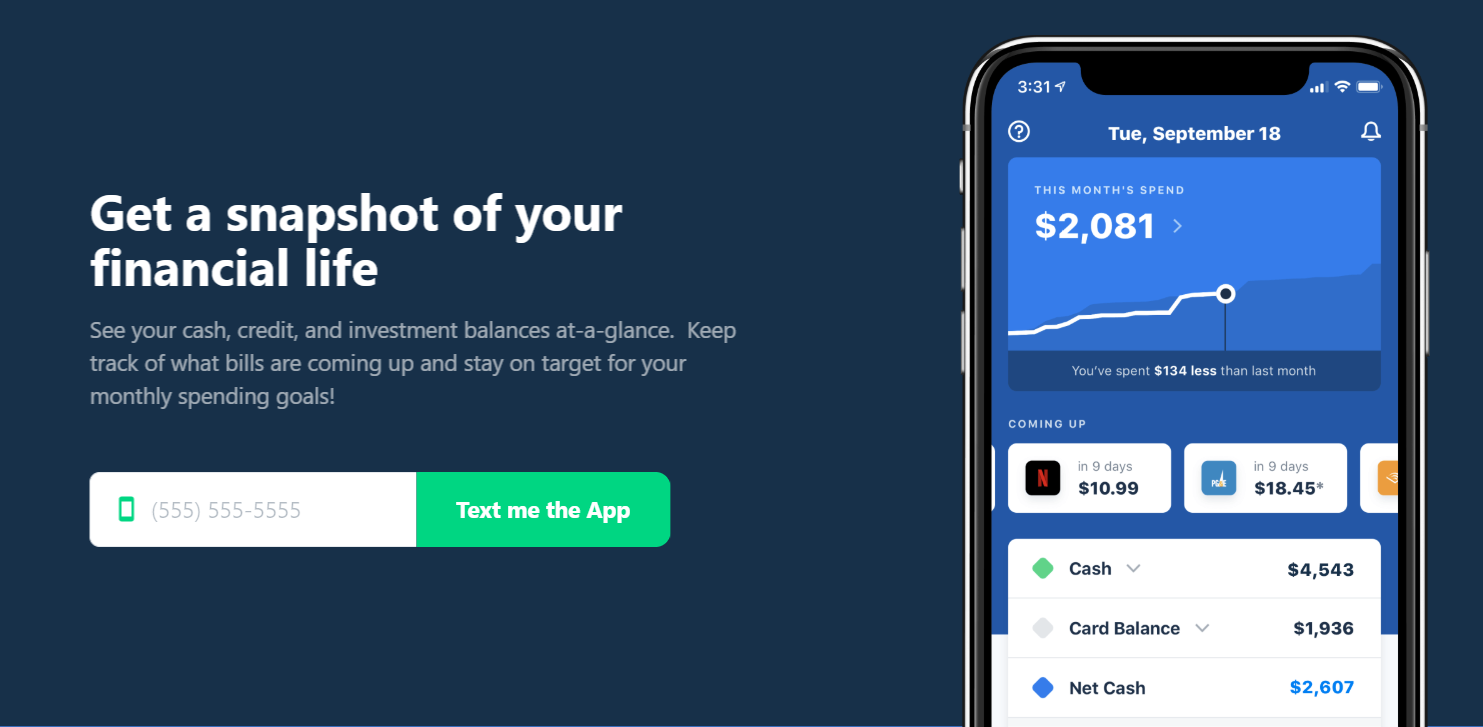

In addition, Truebill also lets you see your cash, credit, or investment balances in a glance. Users can also cancel forgotten, unwanted subscriptions via the help of the monitoring feature introduced in the app. Managing your economic and saving goals each month can be achieved easier by implementing Truebill’s monthly report—which includes a categorization for each expense you spend; whether it’s bills, food, groceries, etc.

Apps like Truebill can be particularly handy—especially for people like me who doesn’t keep track often where their money goes. We tend to overspend and allocate far too little for our future savings. What about you? Do you think Truebill can help you handle your financial management?

Source: entrepreneur.com