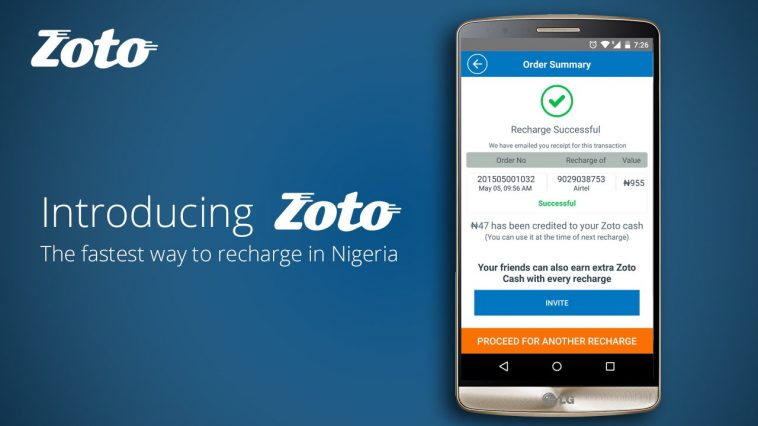

People waste most of their time on long queues for bill payments and bulky airtime recharges. That is why Zoto startup is coming in to help Nigerians save their precious time. Oshone Ikazoboh founded this startup. He is also the chief operations officer (COO) of the company. The platform simplifies payment by making it easier, faster and accessible to those with smartphones. The app is available on either iOS or Android and it has more than one million registered users. Furthermore, the platform registered by the Central Bank of Nigeria (CBN).

The platform uses the Nigerian mobile revolution in reaching out to many people. They use that to make payment possible at anytime and anywhere digitally. Zoto offers services like bill payments, both post, and prepayments. They also do data and airtime recharge. It is also planning to venture into merchant payments, P2P transfers, credit and various financial payments. Zoko has got a staff of 30 since the launch. Moreover, they believe in focusing deeply on the customer.

There is a wide gap in the Nigerian banking sector. Only 44% of the country’s population has bank accounts. This is because of the high cost of opening bank accounts. Lack of enough physical branches is also a factor to the low number. The low number has led to an economy without enough cash flow. Therefore it causes inefficiencies in many systems resulting in poor governance.

Moreover, there is an improvement in digital payment in the country. The utility payments services are expected to go up to 46 million households by 2020. Furthermore, the smartphone acquisition in the country is high. there is an average time spend on smartphone recorded at 193 minutes. It is also recorded that 80% of web traffic comes from mobile in Nigeria. That shows how a smartphone is important in digital facilitation and running e-commerce. However, Zoto believes that it is the solution to the wide gap in the unbanked population.

The platform has most of its users in Lagos Nigeria recording at more than 80%. The company also plans to launch everywhere in the countries. Plans are also underway to launch in other countries in West Africa. The company charges a commission on merchant payments. Moreover, it charges a small fee for bill payments and bookings. Furthermore, the company has recorded an annual growth of 200% in the order made. Moreover, it made five million of the orders in 2017.

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?

We just launched our WhatsApp channel. Want to get the latest news from the Tech in Africa?